Let’s Know About Short Selling

Short selling is a unique technique in the stock market where you can sell share or stock which is not owned by you. In short selling process, you will sell share or stocks which you will lend from a broker or brokerage firm on the condition that you will deliver the stock back to the broker or firm. When you short sell the share, it takes some minutes to complete the process, and then your account is credited with the return.

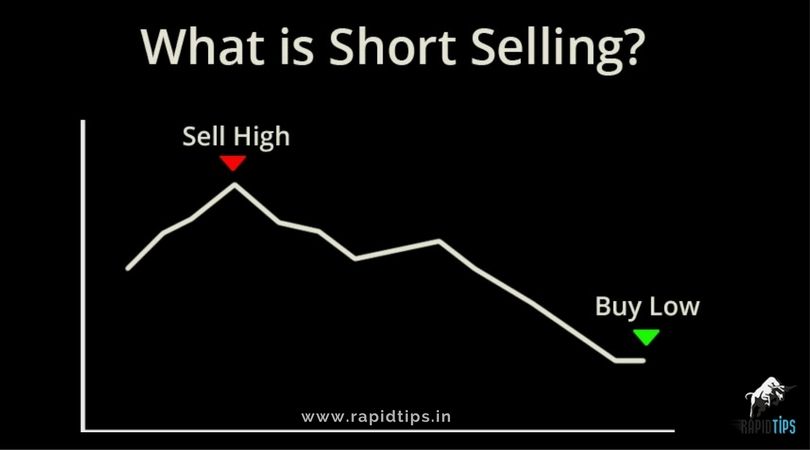

Basically, short selling indicates that you buy stocks which you can predict will fall down in the near future. So after selling the borrowed stock, when the price drops further you can again buy it back which will provide you profit. If you short sell in equity segment, then you have to close the position before the market closes and if you short sell in the F&O segment, and then you have to close the position before expiry.

Attributes of Short Selling

Most of the traders in share market are attracted towards a short sale, and it is mainly because of attributes associated with this technique:

- The primary motive behind the practice of short is for hedging or speculating.

- Short selling is a smooth process whereas a trader you borrow some stocks from a broker or brokerage firm then sell them to the third party. The different in an amount between the price quotations of two parties provides you profit or loss.

- Many people prefer to avoid short selling because it is a perilous process where you risk the borrowed money.

- Short selling is often discredited by many people as it adds to share market volume.

- Short selling requires a lot of experience and research capability so that you can predict the market condition and carry on with your short selling process.

- This process is basically a short selling in intraday, and it provides you the option to make a trade in the slow market.

Short Selling In NSE Stock Market

Short selling in NSE Stock Market indicates you can short sell in NSE market to earn a safe return from the price difference. The Indian market is heavily influenced by European as well as USA markets, so there is a lot of research needed to be done before opting for short selling inNSE stock market.

Basically, when you short sell in NSE market, you can buy or sell stock worth the five times of the capital stored in your trading account. This indicates you can borrow shares worth five times of your account and then sell those shares which you think will go down in the market. So when the price of each share goes down by good margin, you again buy those particular shares, and it provides you a healthy profit margin.

Utilizing the Effects of Gap down and Bearish Market

Bearish market and gap down market are those conditions where Sensex and NIFTY go down by 20% or more. In this situation, the short trader can make a good profit because there are high chances that price of particular stocks will go down gradually. So one sell stocks and then again buy them at a lower price making a good profit.

By, Rapid Tips