Intraday trading indicators are tools used by traders with trading strategies to get more accurate results to the trades and to get maximum returns. There are many indicators available with different purposes, in terms of the time frame of the trend, or whether they are indicating momentum or trend.

Here are the best 3 intraday trading indicators for intraday:

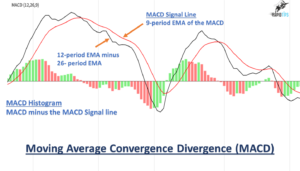

#1 Moving Average Convergence Divergence (MACD)

MACD is one of the best and most reliable day trading indicator for momentum trading. It gives clear identification of trend direction and momentum. MACD Indicator works on the convergence and divergence of two moving averages.

A positive value of the MACD spread indicates an uptrend and a negative value indicates a downtrend. The MACD can be used for the day trading for the purpose of confirming trends and potential price reversals.

#2 Bollinger Bands

Bollinger bands are one of the best indicators to determine overbought and oversold levels. It consists of three bands. The price of the stock moves between the upper and lower bands normally.

The Bollinger Bands can be used with a trading strategy. A combination of Bollinger band with other indicators can provide more accurate results.

#3 Relative Strength Index (RSI)

RSI is the trading indicator that follows the concept of the overbought and oversold signals. It can be set for different time frames and can hold values between 0 and 100.

RSI is one of the easiest best intraday trading indicators for usage. It an excellent momentum indicator, and when the price of the security reaches the 30 or 70 levels, the trader can be altered the set up a trade in the same direction as the break.