Get Best Intraday Trading Techniques

It is very much clear from the name that such type of trading deals with purchasing and selling of shares the same day. Though risks involved are a bit higher than conventional techniques, but there are some exclusive intraday trading techniques to follow for enhancing performance:

As a beginner, it is advisable to seek assistance from professionals as well as experts. Newbies must not step back from learning prior to moving ahead for investment. Below are some alluring couples of regular trading and venture traps that must be adopted for accomplishing some of the best intraday trading tricks:

- Traders must aim at staying away from holding favorable positions overnight

- Better to go for trading in order to enhance profit margin. One must avoid putting all his hard earned money into some scrip in a random manner.

- Regardless of the numbers of scrip you hold, in case the price of scrip seems to break down; better to take an exit. It will prevent you from incurring higher losses.

- Highly experienced stock traders generally square off or selling their scrip whenever the price of the same becomes half. The same technique is helpful in terms of lowering down risks involved.

- After successful placing of money on the scrip, it is high time to wait patiently to verify if the price of the same is to the close proximity of the 2ndIn case of apology, it is advisable to square off at the time of closing the same.

In this blog, you will find useful Intraday Trading Techniques, which will be helpful for you to make profits in Intraday trading.

#1. The Pivot Level Intraday Trading Technique

Many Intraday traders look at pivot levels because they provide excellent support and resistance level. Pivot points provide significant turning points. These pivot points have a simple calculation which is calculated using yesterday’s price.

Trading Using Pivot Levels:

A pivot level is a technical indicator which is used to measure a trend of the stock with the help of yesterday prices. These levels are nothing but an average of the high, low and closing prices from the previous trading day of the stock.

The middle line and the level off which everything else is calculated – it is the primary focus. If the price is trading above the pivot point, it indicates ongoing bullish sentiment for the day and if the price is trading below the pivot point it indicates the bearish sentiment of the stock for the day.

R1, R2, and R3 are termed in the pivot levels are resistance level, and S1, S2 and S3 levels are termed as support levels.

Pivot and RSI for Intraday Trading

RSI and Pivot levels are one of the best intraday trading techniques which are used by most of the intraday traders. In below example, you can see that if the RSI generates an overbought signal and the stock price is at a resistance level gives a strong signal to sell. Similarly, if RSI is oversold and the stock price reaches a support level that confirms the buy signal.

#2. Open High Low Intraday Trading Techniques

Intraday traders have so many different techniques, but one very popular Intraday technique is called the Open-High-Low Intraday trading formula gives good result for day trading. This Intraday trading trick is also quite popular among Indian Stock traders and for Indian stock market, this trick works well with Nifty 50 stocks.

How to Trade Using O-H-L Technique?

- The first step in this trick is to watch the opening rates for NIFTY 50 stocks, you can make your watchlist also.

- For the Buy Trade find the scripts with Open = Low and for Sell trade find the script with Open = High.

- Enter the trade after 5 to 10 minutes of the trade if the opening low or opening high is not breached.

- For Buy trade you can keep a stop loss at opening low and for a sell trade, you can put your stop loss at opening high.

- Book profits at the 1.5 % to 2 % profit target intraday bases do not carry forward the trade overnight.

#3. Intraday Trading Formula for Stock Selection with Market Price Trend

You can select stock for intraday trading by observing the current market price of NSE and BSE for 5 minutes Continuously. If the Current Market Price of any security is,

- NSE > BSE, then Short term trend is up then the prices are expected to rise.

- NSE < BSE, then the down term trend is going on for a short period of time, and prices are expected to fall only till NSE is less than BSE

- IF NSE = BSE, short term trend is neutral and price may fluctuate.

With the help of this Intraday trading strategies formulae, you can find the market trend and using this day trading techniques you can choose stocks for day trading. This Intraday trading technique gives the best result with the high-volume stock.

#4. Intraday Trading Techniques for Stocks

This is one of the successful Intraday trading tricks to earn profits with intraday trading. With the help of this technique, you can select winning stock for intraday trading

In this technique, you can find the stock by analyzing the stocks having upside trend, and in the last 3 to 5 trading sessions continuously rise 15 – 20 %. With the help of Nse India, Moneycontrol website you can select such kind of stocks.

Stocks with such a strong upside trend, in a single day followed by a sharp pullback of 3 to 10% because of profit booking. You can take advantage of profit booking, just you need to identify and confirm the pullback.

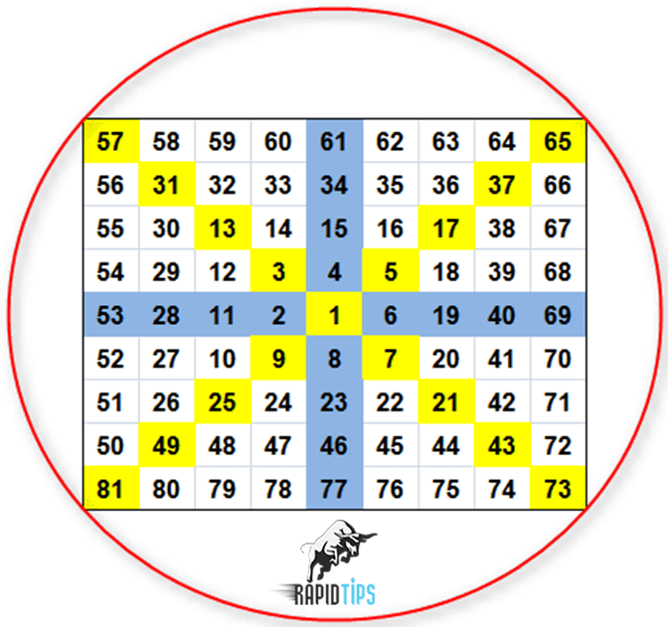

#5. Gann Square of Nine

Gann square of nine is one of the most successful Intraday trading tricks to check different levels. The Gann Square of nine is helpful to identify price and time alignments in order to price forecast. In the Gann Square of nine, the key numbers which are important are.

- 0 or 360 degrees: 2, 11, 28, 53, …

- 45 degree: 3, 13, 31, 57, 91,

- 90 degrees: 4, 15, 34, 61, 96…

- 180 degrees: 6, 19, 40, 69…

How to Use the Gann Square for Intraday Trading:

The main purpose of Gann Square of Nine is:

- Forecasting Support and resistance level.

- Forecasting the day happening breakout.

Intraday traders can use short term level for training.

To use the Gann Chart, replace the starting number 1 with the current market price. The resulting numbers in the cardinal and ordinal number cells are support and resistance levels. On this information, you can buy or sell as per the support and resistance level. Gann’s square of nine also forecasts the degree of price movement base on the circle.

Get Best Formula of Intraday Trading Tricks

Now it is high time to go through some of the best intraday trading tricks to ensure a high level of success at the time of trading:

- As soon as the market reaches the zenith point and holds a probability to come down soon, it is better to go for investment.

- It is a good idea to place your money on stocks that have been well known for featuring a highly strong base. No need to risk your money by going with undervalued ones.

- It has become quite essential to come up with a suitable intraday trading formula when you have got yourself landed into the field of stock trading. By seeking assistance from a stock analyst, your trading may turn towards a profitable trend.

- Last but not least, it is an intelligent idea to go with companies that have gained recognition for featuring a good track record of paying high dividends. Better to prevent one from falling into the prey of loss-making companies.

These are some of the well-known intraday trading techniques that need to be followed in order to fetch alluring benefits from the stock market. Are you ready to take a challenge in case of dealing with intraday trading?

What Intraday Traders Need to Do?

It is fun to note that traders dealing with intraday trading keep themselves involved in the trading round the clock. They keep themselves dedicated to this particular task during the market trading hours. Traders need to dedicate some sort of continuous observation of several types of data in order to properly identify the marketing conditions that go in due favor. Numerous traders have remained successful in developing new systems that are automated in nature. All they do is give a kick start to the job in a manual way. The rest portion of the job is left to the computer system itself!

It has become essential to determine some of the best places where trades enter. It is one of the biggest challenges faced by present-day traders at the most. Through an in-depth analysis of some of the highly specific patterns related to volatility in price along with price action of the early days, it will be easy for traders to determine the best and most suitable time to take entry to the world of trading through some strong moves. If they are successful in developing their skills at the best, it will be easy to determine patterns on the basis of a range of trading, the elasticity of price along with a depth of cup for providing easy focus on golden opportunities.

By Rapid Tips – Free Intraday Trading Tips provider