Best Intraday Trading Strategies: To become a successful and professional trader you must have a powerful trading strategy. The intraday trading strategy is an essential part of the trading setup, especially when you are searching for consistent profits. An effective strategy relies on technical analysis, analysing charts, indicators and different patterns to predict the future movement of a stock price. In this blog, you will get three different intraday trading strategies that can help you to make a profit from intraday trading.

No.1: 9,15,65 MA Cross Over Best Intraday Trading Strategy

Rules for 9,15,65 trading strategy:

- Apply moving average with 9,15 and 65 parameters.

- In this example, MA 10 – red colour, MA 15 – blue colour, MA 65 – the green colour is applied.

- This Intraday trading strategy is working well with 1-hour candlestick time frame.

For Buy Trade Strategy:

- When three moving average (9,15,65) pass through one bullish candle and if the next candle gives the break out of the previous candle’s high then you can go for the buy trade.

- For the buy trade, you can put stop loss at the low of the bullish candle through which all three moving average passes.

Buy Trade Example for Best Intraday Trading Strategy No.1

For Sell Trade Strategy:

- When three moving average (9,15,65) pass through one bearish candle and if the next candle breaks the low of that bearish candle you can go for the sell trade.

- In which you can put stop loss at a high of the bearish candle from which all the tree moving averages pass.

Sell Trade Example for Intraday Trading Strategies No.1

No.2: Gap Intraday Trading Strategies

Mostly gaps occur at the opening time of the market due to the difference in demand and supply, which is quite common. These gaps are created by different factors like news on particular security, earning announcements.

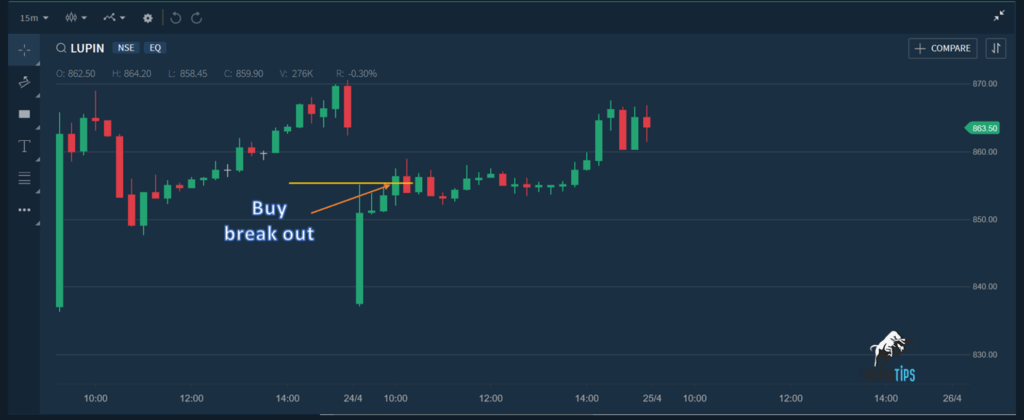

For Buy Trade Strategy:

- Select the security that opens with a gap down.

- There are many software and scanners available from which you can find out which stock opens with a gap down.

- Select the time frame for 15 minutes.

- After 1st candle, wait for its a high break out.

- When the high of a 1st candle is broken, you can take entry for a buy trade.

- Here, 1st candles low = stop loss and target = gap filling of gap.

Gap Intraday Trading Strategies Buy Example

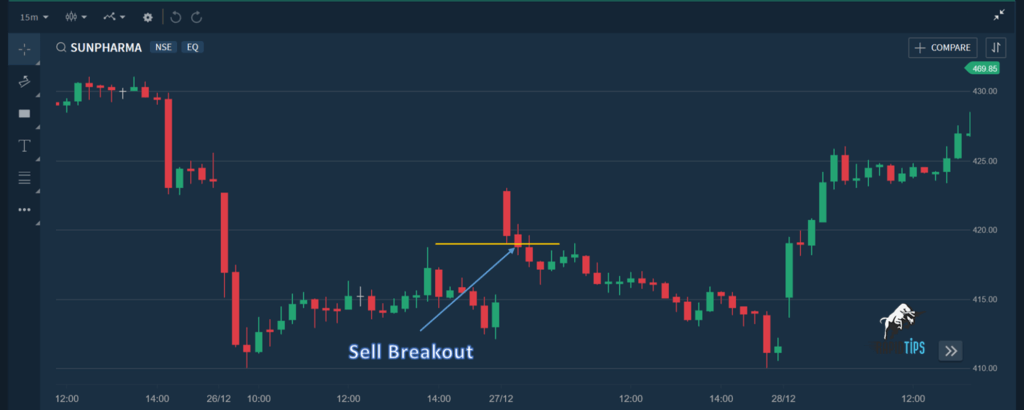

For Sell Trade Strategy:

- Select the security that opens with gap up.

- There are many software and scanners available from which you can find out which stock opens with a gap down.

- Select the time frame for 15 minutes.

- After 1st candle, wait for its a low break out.

- When the low of 1st candle is broken, you can take entry for a sell trade.

- Here, 1st candle’s high = stop loss and target = gap filling of gap.

Gap Intraday Trading Strategies Sell Trade Example

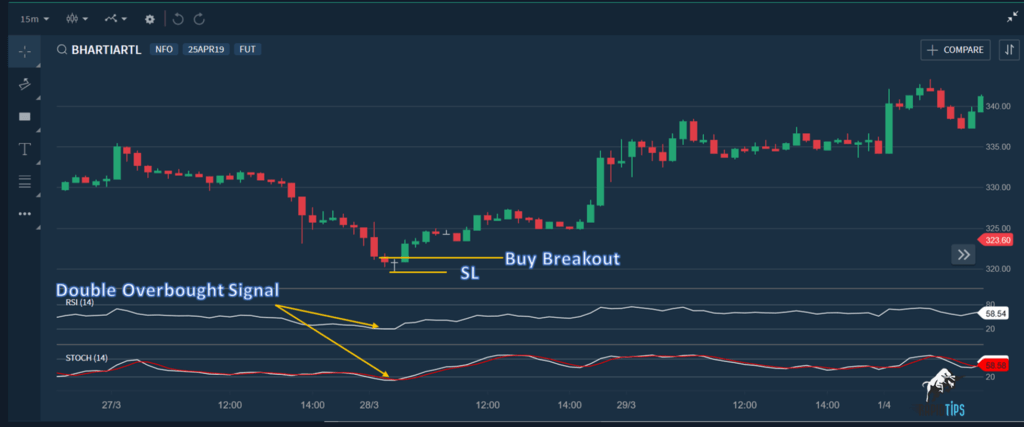

No.3: RSI and Stochastic Oscillator

Rules for RSI and Stochastic Oscillator:

In this strategy RSI and Stochastic Oscillator indicator are required and when both the indicators generate overbought or oversold signals we can go for the trade.

For Buy Trade Strategy:

- When both the indicators go below the lower part of its area, it gives a double oversold signal.

- Once, we get the oversold signal from both the indicator, we can go for a buy trade.

- In the below example, you can easily understand, when to enter and when to put stop loss for a long trade.

RSI and Stochastic Oscillator Buy Trade Example

For Sell Trade Strategy:

- When both the indicators go above the upper part of its area, it gives a double overbought signal.

- Once, we get the overbought signal from both the indicator, we can go for a sell trade.

- From below example, you can easily understand, when to enter and when to put stop loss for a long trade.

RSI and Stochastic Oscillator Sell Trade Example

About :

All these best intraday trading strategies are worked well if you go in depth of technical analysis. It also depends on such factors as a trend, support and resistance, news, etc. Rapid Tips with the best experienced technical analysis team provide best intraday trading strategy & intraday trading tips with minimum stop loss and maximum rewards. Join Rapid Tips today to start your profitable trading journey.